Owning land and passing it down to future generations is integral to the American dream. As Yoopers, we know that our camps are treasured and often passed down from one generation to the other. No wonder there is overwhelming emotion attached to a deceased parent’s house or camp.

Throughout my legal career, I can recall too many instances of children experiencing painful attachment, conflict, and overwhelm related to a deceased parents’ house or camp. Relationships between siblings have ended. Siblings who don’t want the fight have settled for less than their share of the inheritance to avoid further conflict with a more aggressive sibling. Some children have nearly broken themselves financially trying to keep the property because “that’s what my parents would have wanted.” This is why I recommend that my clients check their own expectations and understand the financial implications of inheriting land while your parents are still alive. This may help insulate yourself from the giant emotional burden you could face with the loss of a parent AND then decisions related to the future of their home or camp.

Property issues often extend outside the family

Most of these situations also come with creditors: credit cards, medical bills, taxes, and maybe others. You are not responsible for personally paying the debt’s of your parents. Do not take money out of your personal bank account to pay a credit card or medical bill (for example).

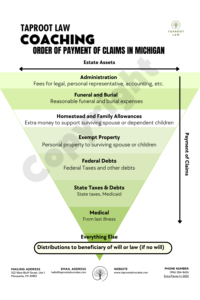

HOWEVER, a creditor has a right to be paid before any family member is entitled to the final distribution of property (For more details, see the graphic on Priority for Payment of Claims below).

If there is no cash to pay them off, you have to put cash in the estate from somewhere. This is the exception. You must personally pay the debts of your parents to get something else you want (like a clear title and ownership to your parents’ home).

Before setting your heart on your parents’ home or camp, there are a few things to think about now:

- Co-ownership. Other people might have the same or equal rights that you have. So you might only get what you want of “ownership of the property” if other people own it with you. For example, a will might state that “all siblings would all be entitled to a parent’s land equally.” This means that all siblings must be co-owners. Unfortunately, co-ownership of land has an increased risk of disputes, especially if that co-ownership is lengthy. If you want to be the sole owner, usually you’ll have to come up with additional funds to pay off any required other co-owners like the siblings example above. I’ll be writing more about co-ownership in the future, so stay tuned!

- Debt generator. Even if land is “paid off” that only refers to the lenders being paid off. That means you don’t have to pay the bank when you sell it, but you still have to pay taxes, insure, and maintain the property while you own it. Depending on how the transaction is handled and what you already own, the property taxes could increase.

- Refinancing. If there is a mortgage on the property and you want the property, you’ll have to refinance the loan so that it is connected with you and your credit. This can be as involved as buying a new house, and there are costs associated with closing that you may have to pay.

Preparing now with an exercise

Taking the family house or camp can have real financial implications that you can and should consider now. Here’s a mental or writing exercise you can do to mitigate stress and overwhelming emotions later:

- Do you really want this place? Or is it too much hassle for your lifestyle? (Sometimes parents overlook this question and assume you want it!)

- Would you be required to have co-owners? Are you comfortable with that?

- Estimate the expenses for the camp.

- Is this something you can realistically afford?

- If you want to own it, could that be accomplished by using co-owners at a tool?

- Which of these questions could you talk to your parents about? Could that be an opening line to talk about the things you can’t talk about?

Talk to a friend or other confidant about what you discover. Create a plan for your next steps, if any. Sometimes just writing it down, and coming back to it helps everything sort out.

By going through this mental exercise, you will have already visited this important economic decision at a time where there may be less crisis and loss. When the time comes, you will be able to take care of your loved ones without analyzing this kind of complicated decision for the first time.

If you have questions related to owning and transferring land, Taproot is here to help! We offer services that help you move forward with your legal issues. Contact us today! Learn more about how we can help at www.taprootadovcates.com or give us a call at 906-284-8426